Td Bank Outgoing Wire Transfer Form – For completing a bank transfer, you’ll have to fill out a formal form to make a transfer. This form is able to be completed by anyone, however the institution that initiated the transfer has to be signed by the form in order to be able to access the funds. One of the best ways to tell what the real reason for the money getting into your bank account is to ask the bank you are using to provide the form. It’s easy to accomplish than you think. However, if your requirement is to fill out a bank transfer form, it’s well worth the effort.

Details you’ll need to make a bank transfer

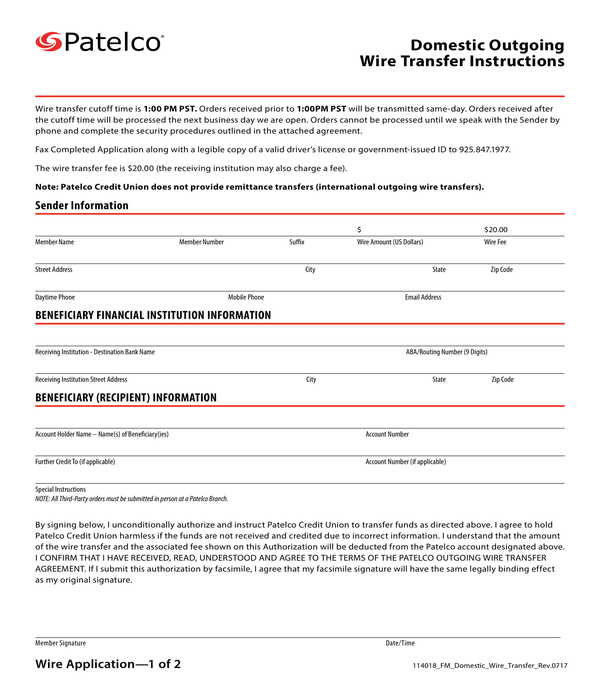

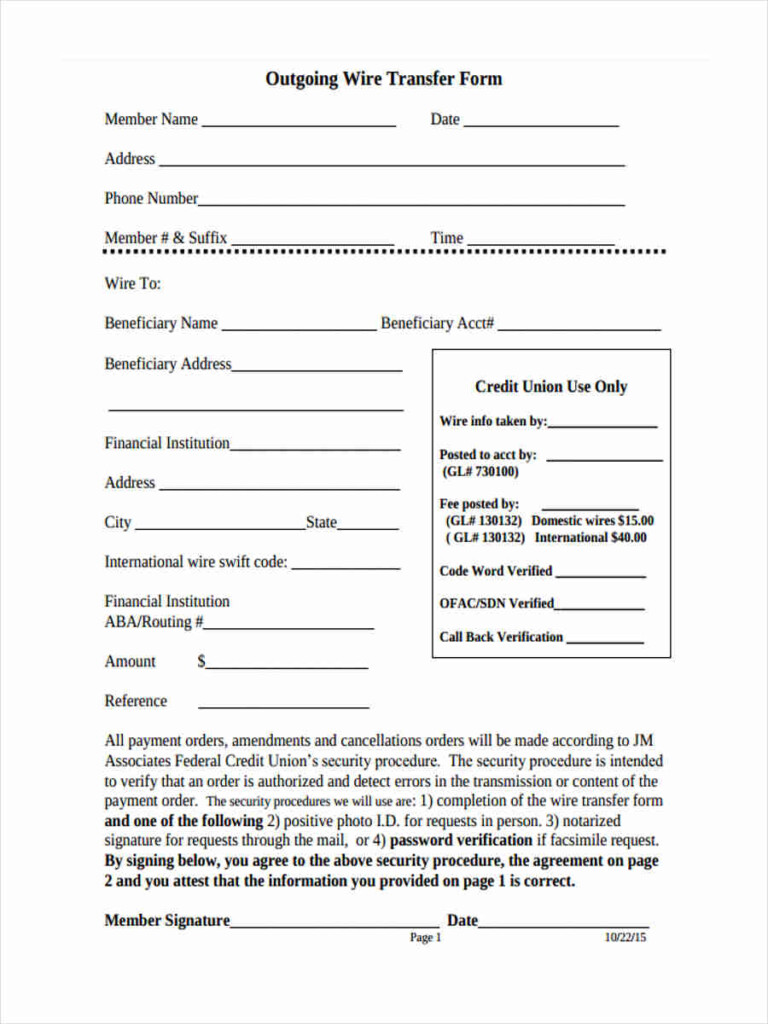

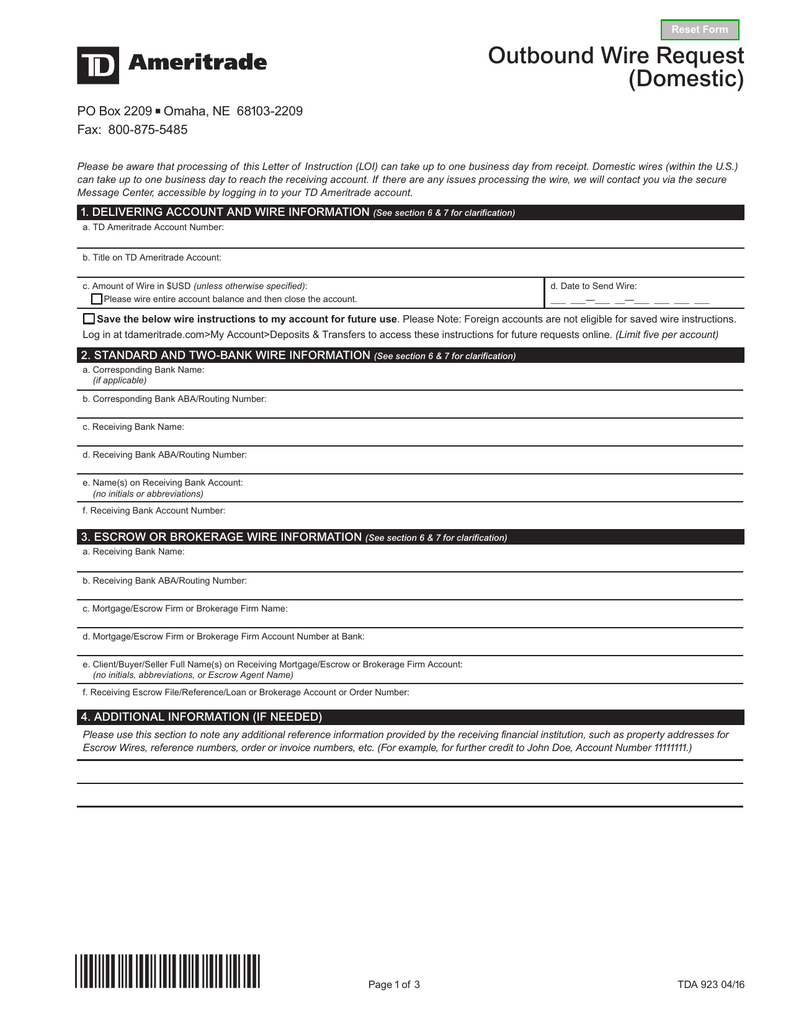

Before you’re able to perform a bank transfer, you need to have all the details necessary for the beneficiary. The recipient should also have access to a savings or checking account and you’ll require their name, email address, information, account number, routing number, and so on. These are the information you need in order to transfer money to a bank. Before you’re allowed to make the transfer, you need to make contact with the recipient’s bank credit union to verify the information.

Information that you’ll need on a transfer form to a bank

First of all, you have to fill out the application for international wire transfers. The requirements for information can vary from one institution to the next. For example, some institutions require a social ss number or Individual Taxpayer Identification number to transfer funds internationally. The other information required will depend on the purpose of the transfer as well as the recipient’s country of residence. If, for instance, you’re giving money to a relative then you’ll need to enter the name of the person who you’re sending the money.

Legal obligations when using the form of bank transfer

There are numerous legal obligations for bank transfer forms. If you’re paying money via one of these channels, your instructions must be clear. The bank of the recipient must make a payment payment by the date you have specified. Or, you can ask the intermediary bank to send your payment order as fast as it is feasible. It’s your responsibility to ensure that your receiving and sending banks to follow these requirements. Here are some guidelines for making use of a form for bank transfers.

Common problems with completing a bank transfer form

The process of filling out an account transfer form can be a bit confusing. You need to fill in the correct application to transfer your account. Certain companies only permit one type of account transfer form, while some have diverse forms for various types of accounts. Find the correct form by calling the new firm or by visiting its website. Keep the account statement of your previous firm in order to fill in the appropriate information. Make sure you sign your name and your social identity number in the application.