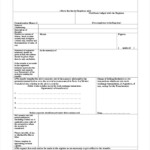

Stock Certificate Transfer Form – A form for transferring stock is employed when the owner of the share wants to transfer the share to the new owner. Shares can be described as fixed identifiable units in capital, representing the share of a shareholder in the company. A shareholder can transfer shares to another through a gift or sale. In either scenario, they require the signatures of at least at least two directors together with the secretary. A decedent’s estate must complete An Inheritance Tax waiver along with a stock transfer form.

Shares are the fixed identifiable units of capital which are a part of a shareholder’s stake within a company

The purchase of shares in a company isn’t the same as owning it. You only own your stake with no additional obligations or liabilities. But, you do have the power to vote in company’s elections and shares are a useful way to exercise your right. Shareholding in a corporation is dependent on the proportion of the owners of the company compared to the total number of shares issued. Shareholders with less than 50 percent of the shares owned by the company are able to have an enormous influence on the company’s shares through an agreement among shareholders.

It is an easy method of giving an individual a portion of the portfolio you have. Giving a share of stock could require the transfer of the shares from your brokerage account to the person receiving the. You’ll need to communicate with your broker prior to making the transfer, but the procedure isn’t necessarily a one-time affair. The following steps will allow you to give stock to an individual. Here are some common reasons to present stock.

They are tax-free

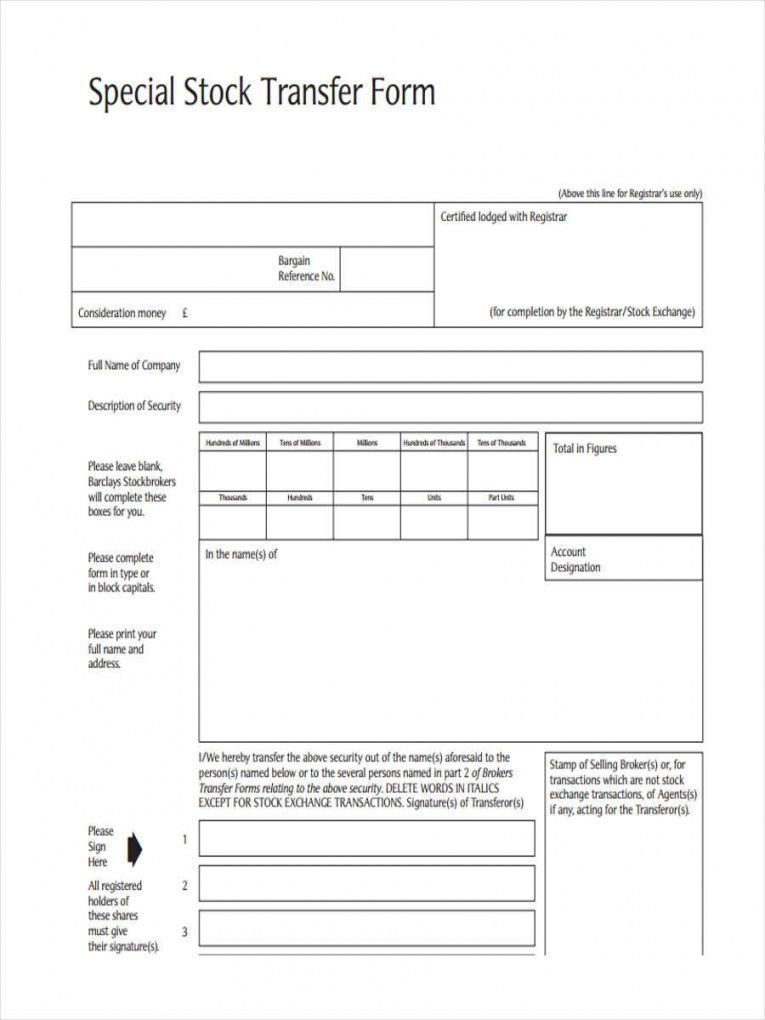

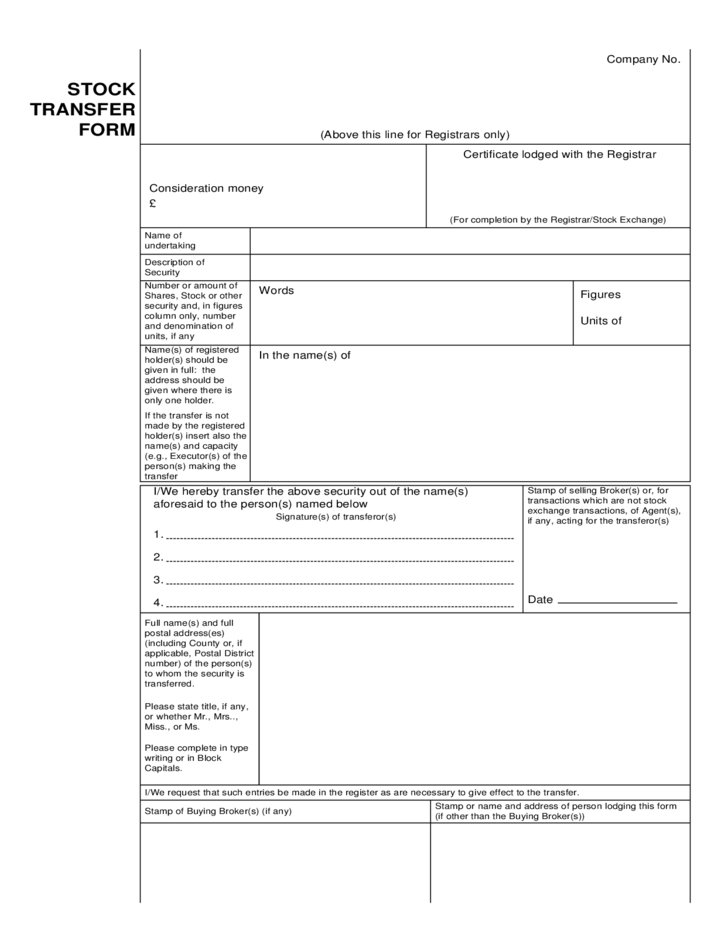

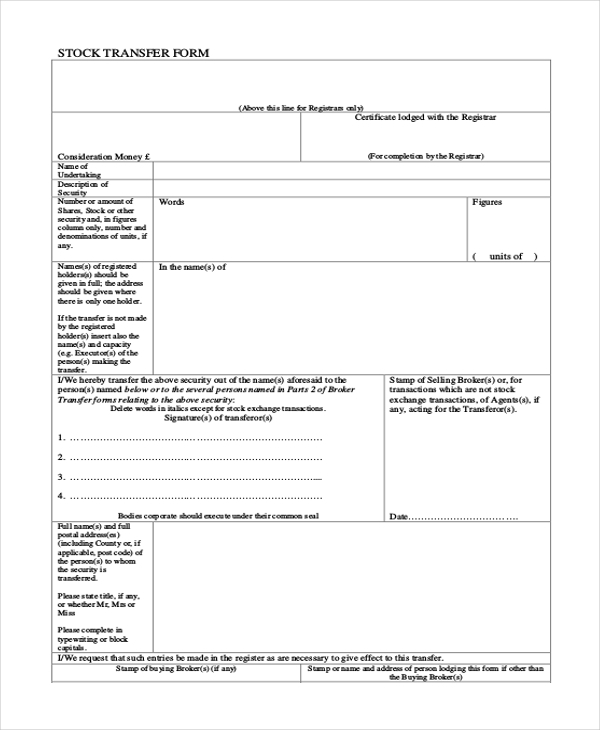

If you decide to sell or transfer stocks, you must file a Transfer Form. Even though this form won’t be included on your tax returns, it contains information about the stock you own. This information is required to determine your cost basis and the holding period. There are two kinds of forms that can be used for this purpose. Alongside Stock Transfer Forms, you might also need an IRS Form 1099B or the Proceeds from Broker and Barter Exchange Transactions.

They require the signature of two directors as well as one secretary.

Any time a share deal is completed that involves shares of a firm must be signed more than two directors as well as the secretary. Share transfer forms are often used for the division of companies or for any transfer of shares of partners. The signatures of the partners must be included on the form to stop disputes and to make sure the documents are true. These signatures can be on facsimile.

They can be delivered to HMRC via their website.

There are two basic types of forms for stock transfer. Both require the signature of a signatory of “wet ink” to be valid. Form J10 is designed for shares that are not or partially paid. It must have both signatories be present. Form J30 may be used for shares that have been fully paid and needs only signing by the transferor. A J30 form is one of the most frequently used types of stock transfer form.