Morgan Stanley Letter Of Authorization For Stock Transfer Form – A form for transferring stock is required when the shareholder of a share would like to transfer the share to an owner who is a new one. Shares can be described as fixed identifiable units of capital that constitute the stake of a shareholder in a company. Shareholders can transfer them to another person by way of gift or sale. In either event, they require the signatures of at least two directors along with the secretary. A decedent’s estate should fill out an Inheritance Tax Waiver along with a form for stock transfers.

Shares are the fixed identifiable units in capital. They are the member’s stake in a company

Purchase of shares of a business does not mean that you are a shareholder in the company. You are only the owner of your stake however, not having any additional obligations or liabilities. However, you do have the power to vote in corporate elections, and shares provide a viable means of exercising that right. Shareholding in a business is contingent on the proportion to the number of owners the company has compared to the number of shares issued. Shareholders with less than 50 percent of shares of the company are likely to have a significant influence via an agreement between shareholders.

The gifting of stocks is the easiest way to offer an individual a portion that is part of your collection. It is possible to gift a stock share could involve the transfer of ownership of the shares from your brokerage account and into the account of the recipient. You’ll need to communicate with your broker about the transfer, but the process can be carried out in a regular. The following steps will allow you to present stock to an individual. Here are some typical reasons to present stock.

They are tax-free

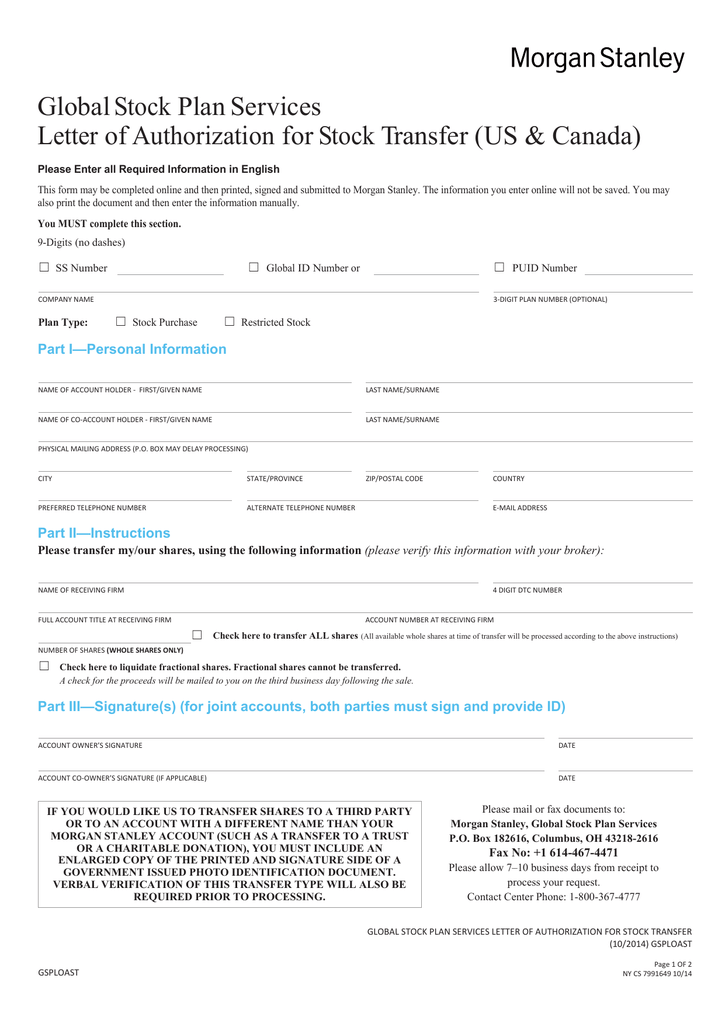

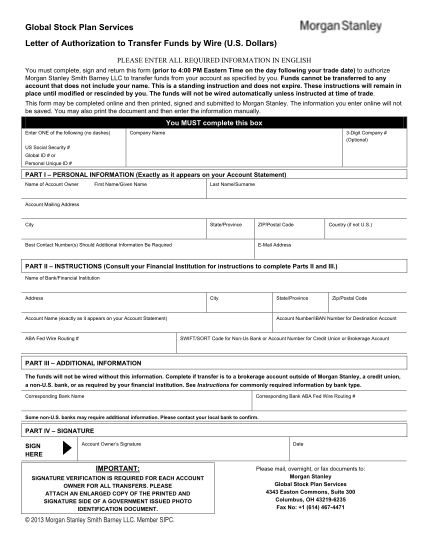

If you decide to sell or transfer stock, you need to complete a Stock Transfer Form. Although it is not added to your tax return, it contains information about your stock. This information is required to calculate your cost basis and time to hold. There are two kinds of forms you can use to calculate this. In addition to Stock Transfer Forms, you may require an IRS Form 1099-B. This is also known as Proceeds From Broker and Barter Exchange Transactions.

They require the signature of two directors and a secretary

When a share exchange takes place in a company must have the signatures of at least two directors as well as a secretary. Share transfer forms are usually employed in the division of an organization or selling shares. The signatures of these officers must be included on the stock transfer form to avoid disputes and to ensure that the documents are correct. Signatures may be taken on facsimile.

They can be delivered to HMRC online

There are two main types of forms for stock transfer. Both require a signatory’s signature in “wet ink” to be valid. Form J10 is designed for shares that are unpaid or partially paid, and needs both signatories be present. Form J30 is utilized for shares that are fully paid and requires only your signature as a transferor. This J30 form is one of the most frequently used types of transfer form used for stock.