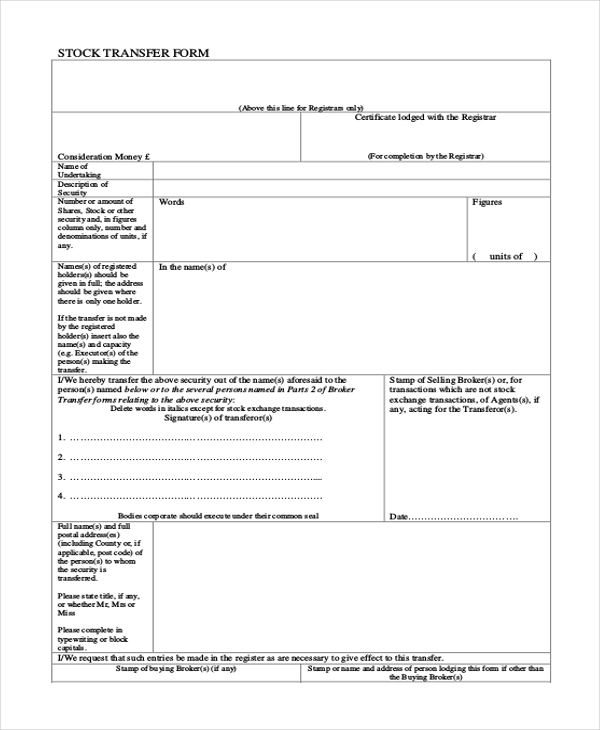

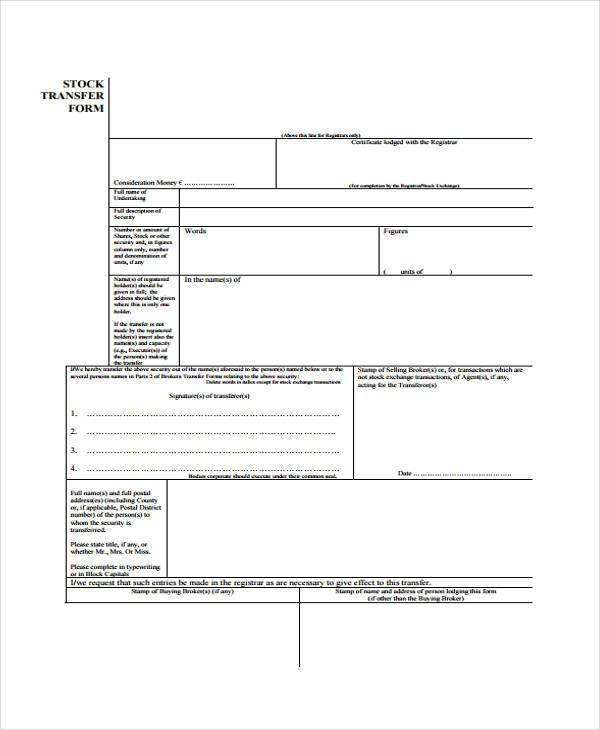

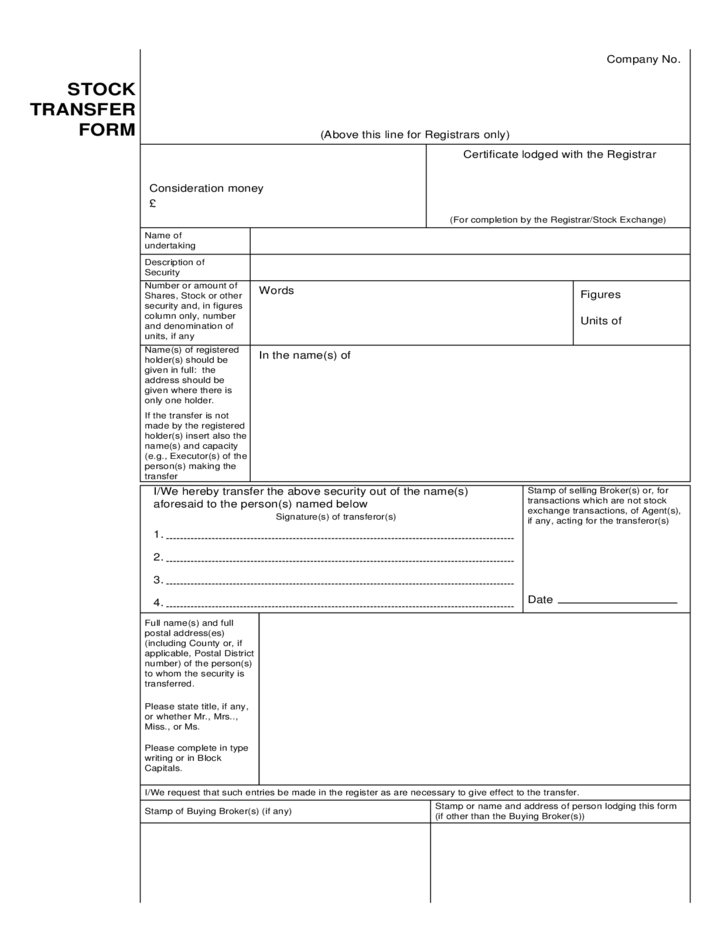

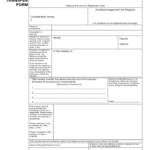

Exelon Stock Transfer Forms – A stock transfer form is utilized when the owner of a share would like to transfer the share to the new owner. Shares can be defined as fixed-identifiable units of capital which constitute the stake of a shareholder in a company. A shareholder can transfer them to a different person through gift or by sale. In either scenario, they require the signatures of at least two directors in addition to the secretary. The estate of the deceased must fill out in the form of an inheritance tax waiver along with a stock transfer form.

Shares can be described as fixed identifiable units of capital . They constitute a percentage of a stake owned by a

When you purchase shares in a corporation, it is not a guarantee of ownership. It is only your stake that you own and don’t have any additional obligations or obligations. However, you do have the option of voting in the company’s elections. Shares are a valuable way of exercising that right. The amount of shares held in a given company is contingent on the proportion to the number of owners the company has compared to the amount of shares issued. Shareholders with less than 50 percent of the shares in the company are in a position to exert considerable influence through an agreement among shareholders.

Giving stocks away is an easy means of giving an individual a portion of your portfolio. It is possible to gift a stock share could mean transferring the ownership of the shares out of your account with a brokerage to that of the person who is receiving it. You’ll need to speak with your broker before making the transfer, but the process could be routine. Following are steps to present stock to an individual. Here are a few of the common reasons to gift stock.

They are tax-free

If you are selling or transferring stock, you are required to file a Transfer Form. Although it is not part of your tax return It contains details about the stock you own. This information is needed to determine your cost basis as well as your time to hold. There are two types of forms used to do this. In addition to Stock Transfer Forms, it is possible to also need an IRS Form 1099-B, or Proceeds from Broker and Barter Exchange Transactions.

They require the signature of two directors and a secretary

Every time a transaction involving shares takes place the shares of a company need to be signed by minimum two directors as well as a secretary. Share transfer forms are often used to separate an organization or transfers of share to partner. The signatures on these officers should be on the form of transfer to stock to avoid disputes and to ensure that these documents are genuine. These signatures could be put on facsimile.

They can be sent to HMRC via their website.

There are two primary types of forms for stock transfer. Both require the signature of a signatory using “wet ink” to be valid. The form J10 is intended for shares that are unpaid or partially paid. It needs both signatories be present. Form J30 is for shares that are fully paid and needs only the signature of the person who is transferring. It is the J30 form is the most commonly used type of form for stock transfers.