Form Of Authorization For My Attorney To Transfer Stock – The form of a stock transfer can be employed when the owner of an interest wants to transfer the share to an owner who is a new one. Shares are a fixed and identifiable unit of capital . They represent the share of a shareholder in the company. A shareholder may transfer them to another through gift or sale. In either case, the transfer require the signatures of at least one director and the secretary. The estate of a decedent should complete an inheritance tax waiver with a form for stock transfers.

Shares are the fixed identifiable units of capital . They constitute a participant’s share in a

The purchase of shares in a company isn’t the same as owning it. Your stake is all yours, and not any additional obligations or obligations. However, you do have the option of voting in the company’s elections. Shares are a good way of exercising that right. Shareholding in a corporation is dependent on the share of the company’s owners compared to the amount of shares that are issued. Shareholders with less than 50% of the company’s shares are in a position to exert considerable influence through the agreement of shareholders.

It is an easy way of gifting someone a piece of your portfolio. It is possible to gift a stock share might require you to transfer ownership of the shares directly from the brokerage account to that of the person who is receiving it. You’ll need to notify your broker for the transfer, however this procedure isn’t necessarily a one-time affair. The steps below will help you give stock to somebody. Here are some of the most common motives to gift stock.

They are tax-free

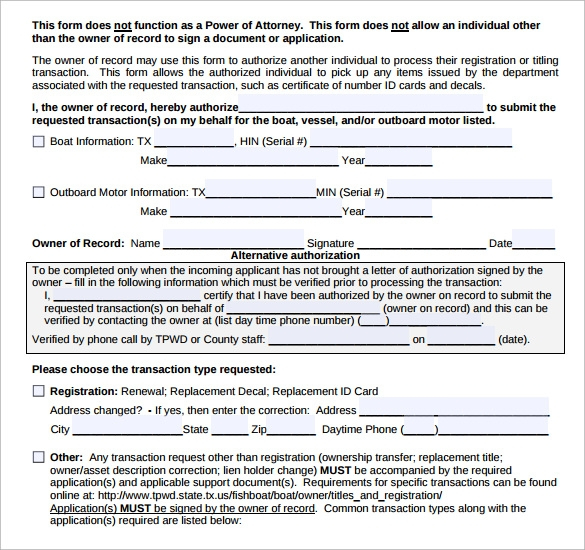

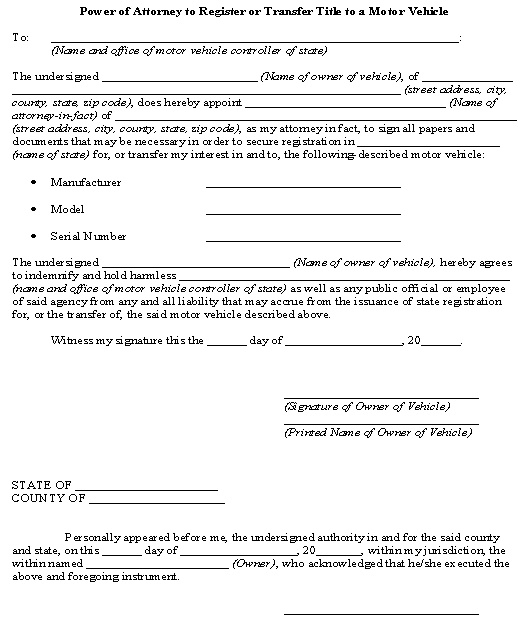

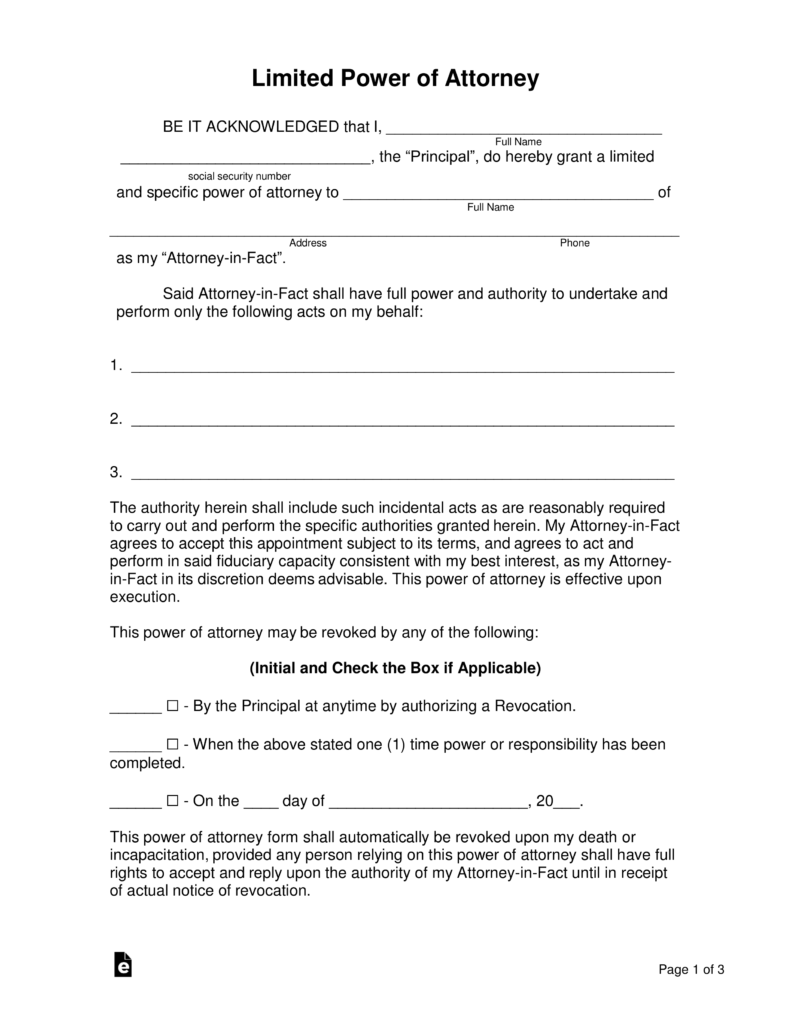

When you transfer or sell stock, you have to fill out a Stock Transfer Form. Although it is not included on your tax returns as such, it will provide you with information about your stock. It is essential to determine your cost basis and the holding period. There are two types of forms to use for this. In addition to Stock Transfer forms, you might also need an IRS Form 1099-B, or proceeds from broker and Barter Exchange Transactions.

They require the signature of two directors as well as an administrator

When a share purchase is completed the shares of the company must be ratified by not less than 2 directors and a secretary. Forms for transfer of shares are generally employed to split any company or in transfers of share to partner. The signatures of the officers must be included on the form for stock transfers to make sure that there are no disputes and that the forms are authentic. These signatures can be placed on facsimile.

They can be sent to HMRC online

There are two main kinds of forms for stock transfer. Both require a signature on “wet ink” to be valid. Form J10 is designed for shares that are not or partially paid. This form is required that both signators be present. The J30 form is used for shares that are completely paid for and require only the signature of the owner of the shares. The J30 form is probably the most used type of form for stock transfers.